UAE 12-Digit HS Code Guide: What Importers Must Know (2026 Update)

February 5, 2026. C4CUSTOMS

Introduction

In 2025, the United Arab Emirates (UAE) began implementing a major reform to its customs tariff system — transitioning from the traditional 8-digit Harmonized System (HS) codes to a more detailed 12-digit Integrated Customs Tariff. This change aligns the UAE with broader Gulf Cooperation Council (GCC) trade standards and global customs modernization trends.

For importers, freight forwarders, and customs clearance agents operating through Dubai Port and other UAE entry points, this update has significant implications for duty calculation, product classification, and clearance compliance.

In this guide, we explain what the 12-digit HS code system means, why it matters, how it differs from previous systems, and what businesses must do to remain compliant and avoid delays during customs clearance.

What Is the HS Code System?

The Harmonized System (HS) code is a global product classification system established by the World Customs Organization (WCO). It provides a uniform framework for identifying goods in international trade and calculating duties, taxes, and regulatory requirements.

Most countries use a basic 6-digit HS code as the international standard. Many nations then extend this code (typically to 8 or 10 digits) to reflect national tariff and statistical requirements. In the UAE and GCC region, the move to a 12-digit system represents an even more granular level of classification.

Why the UAE Implemented a 12-Digit HS Code System

The switch to a 12-digit Integrated Customs Tariff reflects multiple strategic goals:

1. Greater Product Detail and Precision

The extended code allows customs authorities to classify products with finer distinctions, improving the accuracy of duty and tax assessments.

This more detailed classification reduces errors and discrepancies at the point of customs clearance.

2. Harmonization Across GCC Member States

The 12-digit structure is part of the GCC Integrated Customs Tariff, adopted by all member states to standardize classification and trade rules.

This harmonization simplifies cross-border trade within the region, reducing administrative complexity and compliance risk for importers.

3. Support for Digital and Automated Customs Systems

Modern customs platforms, such as the UAE’s electronic clearance portals, require detailed data inputs for automation and risk analysis. The 12-digit system supports digital customs processes, enabling faster automated clearance and improved trade facilitation.

How the 12-Digit HS Code System Works

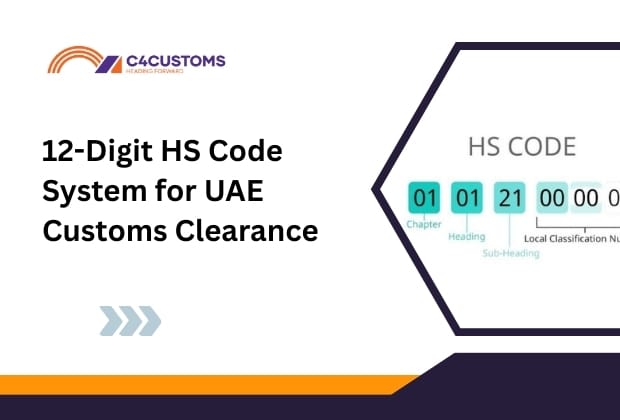

The UAE’s 12-digit HS code builds on the international 6-digit code defined by the WCO:

First 6 digits: Standard global HS code

Next 2 digits: GCC regional extensions

Final 4 digits: UAE-specific classification

This layered approach allows customs to capture more product detail without abandoning the international standard.

For example, while the first 6 digits define the broad category of goods (e.g., furniture, electronics), the additional digits specify material composition, usage, and regulatory conditions important for accurate customs treatment.

Phased Implementation in the UAE

To minimize disruption, the UAE Federal Customs Authority and Dubai Customs introduced the 12-digit regime gradually:

Phase 1 (Aug 2025 – Jan 2026)

Codes required for customs declarations destined for other GCC countries.

Phase 2 (Feb 2026 – Jul 2026)

Extension to imports from Free Zones and customs warehouses to local markets.

Phase 3 (Aug 2026 – Jan 2027)

Mandatory for all imports to the mainland from the rest of the world (RoW).

Phase 4 (Feb 2027 onwards)

Rollout to temporary admissions and temporary trade flows.

These phases allow businesses time to update systems, train staff, and align documentation without interrupting trade flows.

Practical Impact on Customs Clearance at Dubai Ports

For importers and customs brokers, the transition to 12 digits affects every clearance step:

Detailed Duty Calculation

Customs duties and taxes are assessed based on the precise classification provided by the extended code, reducing the risk of underpayment or overpayment.

Accurate Risk & Compliance Profiling

Customs authorities use the extended code in risk engines and automated screening, improving the accuracy of compliance checks.

Reduced Classification Disputes

More specific product codes mean fewer disputes between traders and customs regarding the correct duty or permit requirements.

Improved Customs Analytics

With greater detail, customs agencies can better monitor trade flows, identify patterns, and support economic policy.

What Importers Must Do to Comply

Importers should take the following steps immediately:

1. Review Existing HS Code Listings

Analyze current product codes in your systems and compare them with the new 12-digit classifications.

2. Update Internal Tariff Databases

Ensure your ERP, shipping, and customs clearance systems support the 12-digit format.

3. Train Staff and Partners

Customs brokers, logistics teams, and compliance officers should understand how 12 digits change classification and duty calculation.

4. Verify Codes with Official Resources

Always cross-check HS codes using official UAE customs search tools and tariff guides to avoid misclassification.

Common Mistakes Importers Make

Even with structured classification systems, mistakes happen:

Using outdated 8-digit codes instead of the required 12 digits

Misclassifying products due to lack of detail

Failing to update internal systems and documentation

Ignoring phase deadlines, leading to rejection or clearance delays

All these issues can result in fines, inspections, and shipment holds — especially in high-volume ports such as Dubai Port and Khalifa Port.

Conclusion

The UAE’s transition to a 12-digit HS code system represents a major step in customs modernization and digital trade facilitation. For importers, freight forwarders, and customs brokers, understanding and implementing this change is essential to ensure accurate duty assessments, compliance, and smooth clearance at Dubai and all UAE ports.

As the transition progresses through 2026 and beyond, staying updated with official customs resources and maintaining accurate classification practices will reduce clearance delays and support long-term trade success.

FAQs

The 12-digit format provides deeper product classification beyond the 8-digit level, enabling more precise customs duty and compliance assessment.

The phased rollout began in August 2025 and will be fully applied to mainland imports by 2027.

Yes — all imports and exports must use the correct 12-digit classification during and after transition phases.